Enroll in Medicare in Surprise, Peoria, Phoenix & Areas of Arizona

What Exactly is Medicare?

DID YOU KNOW: In 1966, Medicare spurred the racial integration of thousands of waiting rooms, hospital floors, and physician practices by making payments to health care providers conditional on desegregation!

FACT: President Harry Truman and his wife became the first recipients of Medicare!

Since its inception in 1966, the program has undergone numerous revisions, updates, and changes. The program is now broken into 4 main parts, A, B, C, and D. Below we will provide some basic information on each of the programs, their deductibles, co-insurance, and more…

Medicare Part A

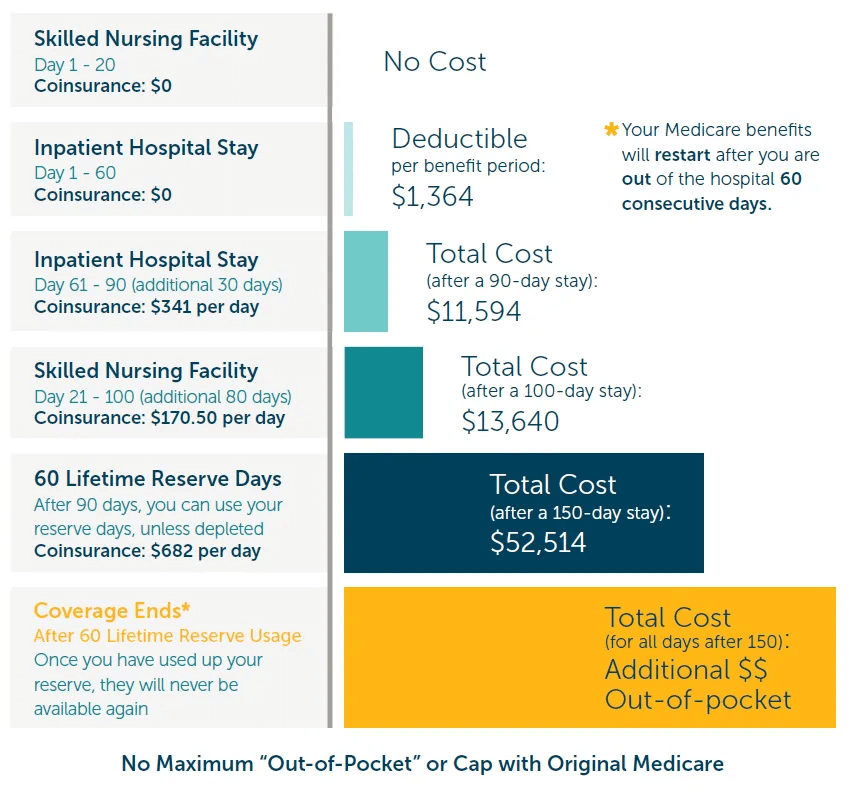

With that said, Medicare Part A is pretty comprehensive but there are several gaps in coverage that you might want to consider. Medicare Part A had an inpatient hospital deductible of $1408, coinsurance per day as $352 after 61 days confinement within one “spell of illness”, coinsurance for “lifetime reserve days” (essentially, days 91-150 of one or more stay of more than 60 days) of $704 per day. There is a little more to these deductibles so take a look at the chart below. There are also deductibles for skilled nursing stays, limits on coverage for blood transfusions, durable medical equipment (covered under Part B), and more. To understand your coverage gaps and how to get the most out of your Medicare benefits, schedule some time to meet with one of our licensed Medicare brokers in Peoria and Surprise, AZ, or give us a call at 623-777-3315.

Medicare Part B

If you are looking to find out more information on Medicare Part B, grab a seat because there is a lot of information to share. Part B of Medicare provides coverage for things like doctor visits, qualifying routine healthcare expenses, x-rays, lab services, and more. Generally speaking, it covers most “out-patient” services and some in-patient services not covered by Part A. Medicare breaks it out into two types of services, medically necessary services, and preventative care services.

Unlike Part A, Medicare Part B has premiums and costs associated with it. Most people will pay a standard premium amount of $144.60 (2020). If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). To find out more about this, give us a call so we can discuss your specific situation, or you can visit https://www.medicare.gov/your-medicare-costs/part-b-costs. In addition to your monthly premium, Medicare Part B also has a deductible and a co-insurance amount that will add to your out-of-pocket expenses for the year. Part B works as a true 80/20 plan meaning that Medicare covers 80% of the qualifying medical expense and you are responsible for the remaining 20%. What many people don’t understand is that there is no lifetime or annual cap to that 20% co-insurance meaning that if you accrue $100,000 in medical expenses, your out-of-pocket could be $20,000 or more! See the graph below that helps break down how this works.

Did you know that you could be subject to a penalty if you don’t sign up for Medicare Part B when you turn 65? That’s right! If you do not sign up for Part B when you first become eligible, your Part B premium may go up 10% for each full 12-month period that you could have had coverage but didn’t. There is a 7-month window to enroll, called your initial enrollment period which starts 3 months before your 65th birthday, the month of your birthday, and then the following 3 months after your birthday. Some exceptions apply here so don’t panic. We can help guide you through this, so you don’t have to pay a penalty down the road. While there is a lot more to Medicare Part B, you can see that it does not cover everything, and it can leave you with a substantial out-of-pocket liability.

Fortunately, we have you covered. Do yourself a favor and set up an appointment to speak with one of our licensed Medicare brokers in Peoria and Surprise, AZ. We can go through the ins and outs of Medicare and make sure that we minimize your out-of-pocket expenses and get you the coverage you need to cover your healthcare expenses

Need help understanding Medicare?

Don’t worry, you’re not alone. Give us a call today or set up an appointment to meet with one of our licensed insurance agents!

Medicare Part C

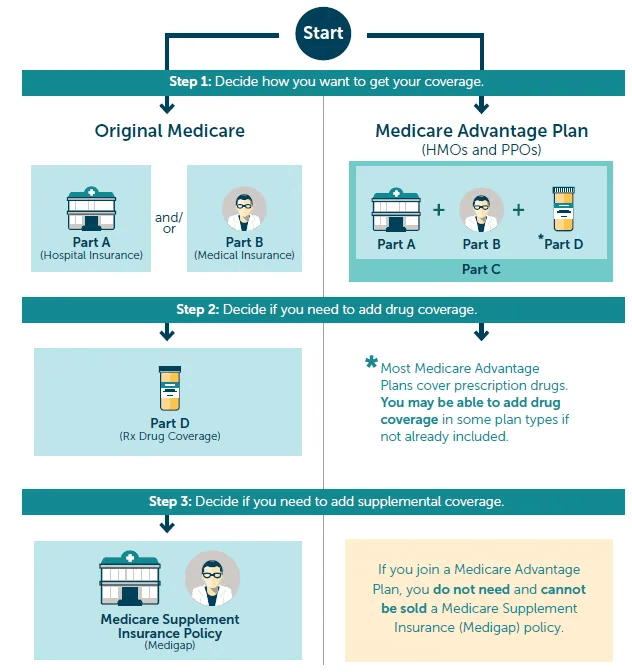

Medicare Part C can be a little tricky so we will try to be as detailed as possible. Part C, as it is more commonly known Medicare Advantage Plans combine both your Part A, B, and D (not all plans cover Part D) into one privately administered health plan. Instead of paying a monthly premium to Medicare, you are paying it to a private insurance company. Part C plans are required to offer coverage that meets or exceeds the standards set by Original Medicare, but they do not have to cover every benefit in the same way. Most Medicare Advantage plans are administered through either a local HMO network or a PPO network. This allows the private insurance companies to control their costs and provide better service to plan participants.

So what does this mean for you? Well simply put, in some cases, you get a bigger bang for your buck. Traditional Medicare does not provide coverage for things like dental, vision, gym memberships, and more and some Medicare Advantage plans do. Other benefits are out-of-pocket maximums, reduced or no deductibles, and more. A drawback of a Medicare Advantage plan is the networks. Unfortunately, to provide these additional coverages, the insurance companies need to control their costs and so they have pre-negotiated rates with providers who are “in-network” and reduced coverage for providers that are “out of network”. The chart below provides a good illustration of how Plan C works compared to Original Medicare.

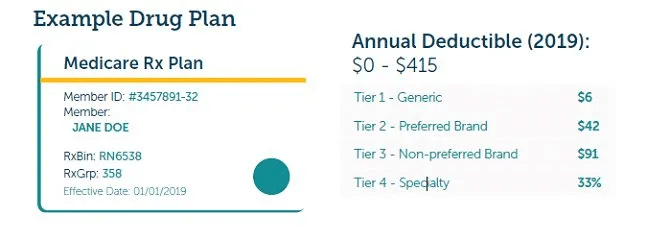

Medicare Part D – Prescription Drug Plans

DID YOU KNOW: Medicare Part D wasn’t established until 2003!

Medicare Enrollment Period

Initial Enrollment Period (IEP)

7-Month “Turning 65 Election Period

Annual Enrollment Period (AEP)

October 15 – December 7

Open Enrollment Period (OEP)

January 1 to March 31

Special Enrollment Periods (SEP)

Individuals who drop their employer group health plan, qualify for the Extra Help (Low-Income Subsidy (LIS)) program, or eligible for both Medicare and Medicaid benefits (Dual-eligibility).

Schedule an appointment today!

As your trusted local independent insurance agent in Peoria & Surprise, AZ, The Turning 65 Advisor is here to help find the Medicare plan that best meets your needs and budget. Call today for a consultation.